Notes: This article will be updated as new information comes in. Also, thank you Dusty & Amy Droz from Dux Somnium Games and my fellow team members Maria, CK, and Jeff for their feedback and contributions to this post.

Every morning, the first thing I do is reach for my phone off the nightstand. But this week I’ve been slower to grab it. Because when I do, I’m immediately bombarded with news about tariffs.

10%, 20%, 54%, 104%, 125%, 145%!?

It’s been… a bit overwhelming to say the least.

Now, I understand that many creators are experiencing significant worry right now, and those feelings are completely valid. The recent tariff developments represent a genuine challenge that wasn’t part of your original planning.

The goal of this guide is to make it a little less overwhelming. And by the end, you should be able to:

- Understand how the recent tariffs will affect your crowdfunding campaign

- Explore thoughtful options for moving forward

Before I get into the guide, here’s a perspective I find useful.

A Perspective That May Help You

As we navigate these changes together, here are some mental frames that might help:

This is a practical challenge, not just a political one. While tariffs arise from political decisions, addressing their impact on your project is fundamentally about finding practical solutions. As much as possible, I try to remove emotion and view it more as a math problem.

You’re not alone in facing this adjustment. The entire crowdfunding community is working through these changes together, and shared resources are emerging. I’ll share a bunch of those resources from other voices in the community later in the guide.

Uncertainty is a natural part of entrepreneurship. While this particular challenge may feel overwhelming, building a business is always unpredictable. I like to remind myself that when things are feeling especially uncertain.

Tariff situations evolve over time. Economic policies often change, and what seems fixed today is very likely to change in the future. In the case of these high tariffs, I believe it’s very likely they will go down.

There are multiple pathways forward. Every challenge presents different options, and finding the approach that works best for your specific situation is entirely possible.

Now, let’s explore the fundamentals to help you navigate this situation with greater confidence.

Also, here’s a quick overview of what we’ll be covering in this post if you want to jump around:

Contents

- A Perspective That May Help You

- How do tariffs work?

- So What Do You Do About Tariffs?

- What To Do If Tariffs Put You Under Your Target Gross Margin?

- The US Market Is Important, But It’s Not the Only Market

- Other Tips to Help with US Tariffs

- Let’s finish with some philosophy

- US Tariffs & Crowdfunding: Resources

- US Tariffs & Crowdfunding: Frequently Asked Questions

How do tariffs work?

Here’s a quick primer on US tariffs:

- A tariff is a tax on products that are entering the US.

- It is a percentage of the “declared value” of your product that appears on the commercial invoice. Another way of saying “declared value” is the cost to make your product.

- To be really clear, the tariff is not based on the retail price of your product.

- You must pay this tariff for your product to be released from US customs.

- US tariffs affect any creator who is importing products into the US. That means even if you are based outside the US, if you sell into the US market, the tariffs will affect you.

The current administration has been changing tariffs for each country rapidly, but with most crowdfunding creators manufacturing in China, I’ll use China as the primary example.

As of today (April 9th), US tariffs on China are now 145%.

That means that if your product costs $10 to make, the tariff will be:

- $10 x 145% = $14.50

Yeah, that’s a lot.

But don’t go tossing your idea in the trash or increasing your prices just yet. Let’s talk about your options.

So What Do You Do About Tariffs?

With tariffs, your costs are going to go up, so obviously you raise prices, right? Not exactly.

Your first choice should not be to raise prices. Actually, raising prices should be your last option. And when I say “raise prices” I mean either by:

- Raising your retail price or…

- Charging an extra “tariff fee” to the backer

When you raise your retail price, it’s very difficult to go down again in the future. And if you charge an extra tariff fee to the backer, it won’t be the best customer experience.

With all that said, even though raising prices is the last option, it’s still an option. Your margins may not be able to support the tariffs so you may have to raise prices, but again, it should be your last resort.

To figure out what you should do, I’m going to walk you through a framework to help you decide whether or not you need to raise your prices. It’s all based on choosing how much money you need to make per sale (target profit margin) and working backwards from there.

But before we get into your margins, we need to start with your retail cost.

1. Calculate Your Retail Cost Without Tariffs

The general rule of thumb around calculating your retail cost is somewhere between 5 to 7 times your landed cost, meaning the cost to get one unit to your fulfillment center.

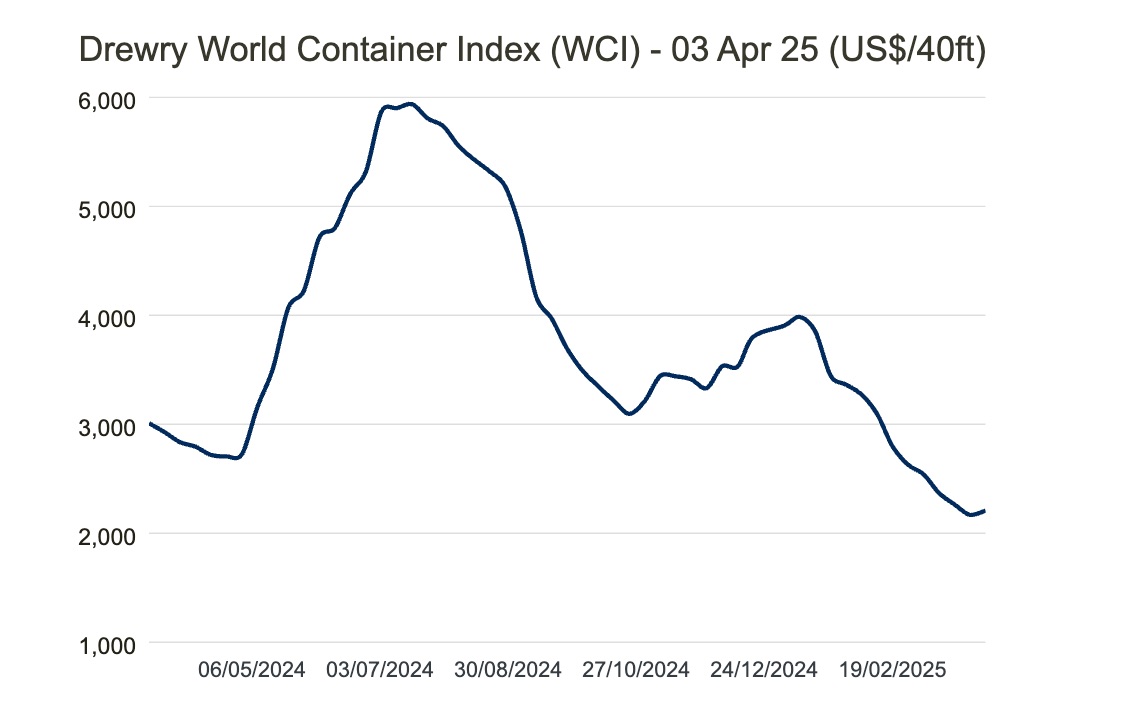

But I’d recommend making it based on your cost to produce your product and not the landed cost, which would include freight (the cost to ship from the factory to your fulfillment center). That’s because the price of freight can fluctuate so much that it’s better to base it on something that’s more stable. Just take a look at how the price of freight has changed over the year (according to the Drewry World Container Index):

In one year, the freight price increased by over 100% and then decreased by over 50%, bringing the price down below where it started. That volatility shouldn’t be priced into your retail cost.

This same logic should be applied to tariffs.

The tariff increase has been stark and sudden. Again, it may go up more. No one actually knows. But because it’s so unstable, I’m not going to use it in my initial retail price calculation.

Instead, I’ll only look at the cost to produce my product because it’s very unlikely it will change anywhere close to as dramatically as freight costs and tariffs.

For example, let’s say that your cost to produce your product is $10 and you’ll use a 7x multiplier to get your retail price. Your retail price would be:

- $10 cost to produce x 7 multiplier = $70 MSRP

Now that we know your retail price, we can move on to understanding your costs.

2. Choose Your Target Gross Profit Margin

Now we need to figure out how much money you want to have left over after you sell one of your products. That’s called your gross profit. Just to make sure we’re all on the same page, bear with me for a second while we go through some definitions:

- Gross Profit = Retail Price – Cost of Goods Sold

- Gross Margin = Gross Profit ÷ Retail Price

Your cost of goods sold (COGS) are all the costs associated with getting the product from the factory floor to your customer’s front door. You’ll find conflicting advice on what to include in your COGS. For example, most accountants wouldn’t put advertising costs, platform fees, and payment processing in your COGS, but to me it makes sense to include them as they are directly tied to revenue.

Most Kickstarter creators will have target gross margins of between 40-50%. That’s because a business should be able to support its fixed operating costs (labor, rent, etc.) with a 40-50% gross margin while also leaving enough for the creator to support themselves. That means a creator with a target gross margin of 40% would want their COGS to be 60% or less of their retail price. For example, if their retail price was $70, then their COGS should be $42 or less.

With the target gross margin set, let’s move on to mapping out your COGS.

3. Calculate Your COGS

Next we want to figure out how much it’s going to cost every time you sell one of your products. Every business is going to be a bit different, but most crowdfunding creators will have costs that look like this:

- Cost to produce one unit (manufacturing costs)

- Freight (cost to ship from the factory to your US fulfillment center)

- Last mile shipping (cost to ship from fulfillment center to customer’s door – it’s normal to have backers cover this)

- Payment processing (cost of credit card fees – usually ~3%)

- Platform fees (cost of the crowdfunding platform – usually 5%)

- Advertising (cost to acquire a customer – 25% is a good target for this)

For example, let’s say your COGS looked like this:

| Categories | Cost |

| Cost to produce one unit | $10 |

| Freight | $2 |

| Last mile shipping | $0 |

| Payment processing (3%) | $2 |

| Platform fee (5%) | $4 |

| Advertising (25%) | $18 |

| Total Costs | $35 |

| Target Costs | $42 |

If we keep the same example going as before and have a 40% target gross margin on a $70 sale, then that’d mean our target cost was $42. In this situation, we could increase our costs by $7 and still be within our 40% gross margin target.

So now let’s add tariffs to this example.

The tariff would be charged on the cost to produce on unit:

- $10 X 145% = $14.50

If we add that tariff to the COGS we get:

- $35 + $14.50 = $49.50

This would still put us above our target cost threshold of $42. Because of that, in this example, we would need to do something to make our margins work.

What To Do If Tariffs Put You Under Your Target Gross Margin?

If tariffs are putting you under the target gross margin, you have a few levers to pull to try to get back in the black. I would go in the following order:

Lever 1: Audit all of your costs

From manufacturing to last mile delivery, this is the opportunity to optimize even the smallest costs. As we’ve seen in previous sections of this article, every little cost matters at the end of the day. Even saving cents on every unit in multiple spots of your supply chain can make a big difference in aggregate.

Here are some places I would recommend looking to optimize:

- Work with your manufacturer to see if you can cut costs by using different materials

- Try to cut weight by using lighter materials – heavier items can incur higher parcel shipping costs

- Think through the likely ROI on every marketing decision you make and prioritize marketing where attribution is easier to get. I’d recommend critically evaluating:

- Going to conventions / conferences

- Paying influencers to review your product

- Advertising on any platform outside of Meta

- Invest in education and learn how to do some things yourself or with guided support

If you can’t make the numbers work after doing this, then move on to the next lever.

Lever 2: Charge the backers for tariffs after the campaign

Just like you charge for shipping, state taxes, and VAT separately, you can do the same for tariffs. I think this is better than increasing your retail price because once you increase your retail price, it’s really hard to go back. With that said, you’ll want to be careful with how you message this on your campaign.

Make sure you communicate on the campaign that an extra charge may be added for tariffs in the pledge manager. This is already very normal to do for shipping since shipping rates may change. I don’t think the majority of backers will have an issue with this if it’s clearly communicated that US backers will have an extra fee.

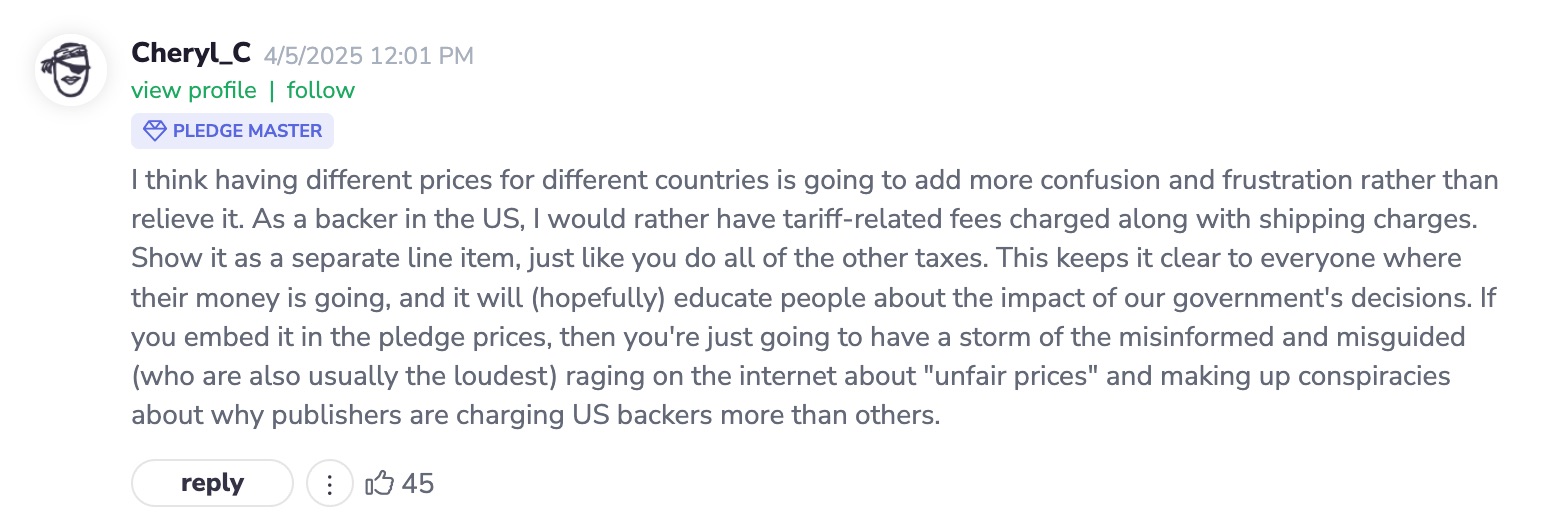

Check out this comment on Marcin’s blog post – he’s the CEO of Gamefound – from a backer who agrees that they’d rather have tariff-fees charged separately:

Also, it’s interesting to note that we have a good example of what backers do when they are charged a tax post-campaign. Remember that most backers outside the US already pay extra fees with VAT and still buy crowdfunding products. The fee they pay with VAT isn’t small either. It’s charged on the sale price, meaning it will likely be much higher than any US tariff that’s charged on the cost of production.

Lever 3: Raise your retail price

You may explore all the previous options and decide that raising your retail price is best. This may be for a variety of reasons, but one that comes up a lot is that the margins aren’t working when selling to wholesalers and/or distributors.

For example, in the tabletop game industry, distributors typically expect to buy the game for 60% off the retail price. If after adding the tariff, the gross margin is less than 40%, the numbers won’t make sense with the distributor. In this case, it may make sense to raise the retail price.

I do want to stress that you should be very careful about raising your retail price. Once you do that and start selling to wholesalers and distributors, it will be very difficult to decrease your retail price again in the future.

The US Market Is Important, But It’s Not the Only Market

The US is obviously a huge market, but let’s not forget it’s not the only market. A large percentage of the total funding on crowdfunding campaigns come from countries outside the US.

If you’ve never run a campaign before, here’s how you can verify what I said yourself.

On Kickstarter, you can see the top 10 countries backers are coming from for any campaign. Just click on the “community” tab and you’ll see it. It looks something like this:

For example, on Sea Beasts, a board game that launched on Kickstarter, the distribution looks like this:

- 3,317 backers from the USA

- 5,414 backers total

- 61.3% of backers are from the USA

And on UNA, a tech product currently live on Kickstarter, the distribution looks like this:

- 520 backers from the USA

- 1,098 backers total

- 47.35% of backers are from the USA

You should try to avoid the US tariffs for backers outside the US by shipping your product to fulfillment hubs not based in the US.

Keep this in mind when you are doing your numbers. You may decide that you are willing to eat some of the decreased margin in the US because the margin is higher in other parts of the world.

Other Tips to Help with US Tariffs

Here’s a list of other tips that I didn’t have a good section for so I’ll throw them here:

- Ask your manufacturer to separate the material costs from administrative & tooling costs on the commercial invoice. Doing this will ensure that your tariffs are calculated on the lowest amount possible.

- Do not spend your crowdfunding funds on anything not required to produce your product until after you have delivered the product. Don’t buy yourself something nice with the crowdfunding funds. Leave it in the bank account and only spend the money on stuff directly related to making and fulfilling the rewards.

- Avoid stretch goals that add additional costs. The positive effect of stretch goals is arguable already. Don’t feel pressured to add stretch goals that unlock rewards that only add additional cost to your campaign.

- Hire a tax professional. There are ways to do your taxes so that you do not pay tax until you have delivered your goods. Make sure you talk to someone that sets you up correctly to do this.

- Ask distributors / wholesalers to share some of the burden. Instead of selling at a 60% discount, ask if they will buy at a 58% discount and share some of the burden of the tariff.

- Develop a China +1 manufacturing strategy. For many products, China is the best in terms of cost and quality. But it may be useful to find the next best country to manufacture your product. Ask your manufacturers in China if they are setting up manufacturing in other countries – some already have in anticipation of tariffs.

I’ll keep adding to this list as I get new tips.

Let’s finish with some philosophy

Whenever things seem impossible, I think about the book The Obstacle Is The Way by Ryan Holiday. Don’t worry if you haven’t read it. This quote sums it up pretty nicely:

“The obstacle in the path becomes the path. Never forget, within every obstacle is an opportunity to improve our condition.”

Tariffs are a big obstacle in the way of profitability. But at the same time, all of us have to go down this path. And in doing so, we have the opportunity to improve our condition:

- We can understand our numbers better

- We can become more efficient and cut costs that aren’t necessary

- We can start to focus on the stuff that produces ROI

And in doing all of this, ultimately, we can launch our product.

This is a rapidly changing subject so we’ll be producing a lot of content around tariffs and general business advice going forward. Also, see resources below around tariffs that may help as continued reading/watching.

Lastly, if you have any questions, feedback, or just want to chat, feel free to reach out to me directly at [email protected].

US Tariffs & Crowdfunding: Resources

See below a list of resources from around the web on US tariffs and crowdfunding:

Crowdfunding Platforms

Tabletop Games

US Tariffs & Crowdfunding: Frequently Asked Questions

What is a tariff?

A tariff is a tax on the declared value of goods coming from another country.

What are the current US tariffs (as of April 10th)?

Here are the current US tariffs on select countries according to CNBC:

| US Tariff by Country or Sector | Latest Rate of US Tariff |

| China | 145% |

| European Union | 10% |

| Canada | 10% for goods not covered by USMCA |

| Mexico | 10% for goods not covered by USMCA |

| Japan | 10% |

| India | 10% |

| Vietnam | 10% |

| Australia & New Zealand | 10% |

| United Kingdom | 10% |

How is it calculated?

It is a percentage of the “declared value” of your product that is shown on the commercial invoice from your manufacturer. The declared value is the cost to make your product and is not your retail price.

Are tariffs charged on freight?

Currently it is not, but that may change.

When is the tariff charged?

When your goods are being held in customs you must pay the tariff for your goods to be released. This is typically paid by your broker and they will then invoice you directly.